The introduction of Corporate Tax (CT) in UAE via issuance of Federal Decree Law No. 47 of 2022, has got a major impact on all businesses in UAE.

All the Companies operating in Free Zones in UAE also fall within the ambit of the UAE Corporate Tax regime and are obligated to register for CT, maintain Proper Books of Accounts under IFRS (mandatory for companies whose annual turnover exceeds AED 50 Million) or IFRS for SME’s (option given to companies whose annual turnover is below AED 50 Million) and file their CT Return to the Federal Tax Authority (FTA) annually. However, the overall impact of UAE CorpTorate Tax on various Free Zone Companies, depending upon which Free Zone they are incorporated in, and their business activities and business model will vary from one Free Zone Company to another.

There are more than 50 Free Zones in UAE spread across its Seven Emirates. There are some Free Zones in UAE, whose Decree or Charter under which they were established contains the provision for a Corporate Tax Holiday for companies in that Free Zone carrying out Qualifying Business Activities for a period of 50 Years, whereas there are some Free Zones in UAE, whose Decree or Charter under which they were established, does not contain any provision for Corporate Tax Holiday.

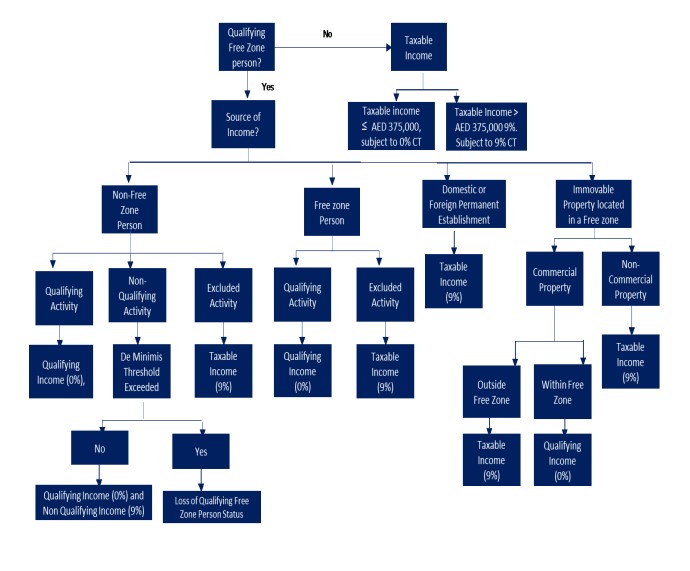

Accordingly, the Ministry of Finance (MOF) of UAE has notified the Free Zones in UAE whose Decree or Charter contains a Corporate Tax Holiday provision as being eligible for 0% UAE Corporate Tax Benefit to the Companies carrying out Qualifying Business Activities in accordance with Cabinet Decision (CD) No.55 of 2023 and Ministerial Decision (MD) No.139 of 2023 issued recently on the applicability of CT to the Free Zone Companies. The Companies incorporated in the Free Zones which are not notified by the MOF of UAE to be eligible for 0% Corporate Tax Benefit, will however, not be considered as Free Zone Person (FZP) for the purpose of UAE Corporate Tax and the provisions of UAE Corporate Tax will apply to them in exactly the same way as they are applicable to the Mainland Companies in UAE.

A Free Zone Person (FZP) is a legal entity that is incorporated, established, or registered in a Free Zone notified by the UAE’s Ministry of Finance to be eligible for 0% Corporate Tax Benefit for Qualifying Business Activities. However, in order to become a Qualifying Free Zone Person (QFZP) under the UAE Corporate Tax Law, certain additional conditions must be met by such FZP. These conditions include maintaining adequate substance within such Notified Free Zone in UAE, deriving Qualifying Income as specified in CD No.55 and MD No.139, not carrying out any Excluded Activity mentioned in MD No. 139, not electing to be subject to CT at Standard CT Rates under Article 19 of the CT Decree-Law and preparing and maintaining Audited Financial Statements as per MD No.82 of 2023.

A QFZP that meets the conditions outlined in Article 18 of the CT Decree-Law and is subject to CT under Clause 2 of Article 3 will be subject to UAE CT at the following rates:

∙ 0% on Qualifying Income; and

∙ 9% on Taxable Income that is not Qualifying Income.

Qualifying Income refers to any income derived by a QFZP that is subject to a 0% CT Rate in accordance with CD No.55 and MD No.139. Only QFZPs earning Qualifying Income can benefit from the 0% CT Rate. Qualifying Income includes income derived from transactions with other FZPs, except for income derived from Excluded Activities, as well as income derived from transactions with non-FZPs (including overseas customers) in respect of Qualifying Activities that are not Excluded Activities. Non-Qualifying Income is income derived in a Tax Period from Excluded Activities or activities that are not considered Qualifying Activities as per CD No.55 and MD No.139.

Qualifying Activities include the following:

∙ Manufacturing of Goods and Materials;

∙ Processing of Goods and Materials;

∙ Distributions of Goods or Materials in or from a Designated Zone to a customer involved in reselling those Goods or Materials.

∙ Ownership, Management, and operation of Ships;

∙ Regulated Reinsurance Services;

∙ Regulated Wealth and Investment Management Services;

∙ Headquarter Services to Related Parties;

∙ Treasury and Financing services to Related Parties;

∙ Regulated Fund Management Services;

∙ Logistics Services.

However, there are certain Excluded Activities that are not considered Qualifying Activities. These include income derived from transactions with natural persons, income derived from certain regulated financial services and activities such as banking services, income derived from intangible assets, and income derived from commercial immovable property located outside of notified free zones and other immovable property located within or outside notified free zones.

Earning income from ‘Excluded Activities’ or any other Income that is not a ‘Qualifying Income’ will disqualify the FZP from eligibility for 0% UAE Corporate Tax if such income exceeds the de minimis threshold i.e...non-qualifying revenue earned by an FZP in a financial year, must not exceed either 5% of their total revenue or AED 5 million, whichever is lower.

If a QFZP fails to meet any of the conditions mentioned in CD No. 55 or MD No.139, it will cease to be a QFZP according to the provisions of Article 18 of the CT Decree Law. This disqualification takes effect from the beginning of the relevant Tax Period and continues for the subsequent four Tax Periods.

Summary of UAE Corporate Tax for Qualifying Free Zone Person (QFZP)

| Income derived by QFZP From | Examples of customers | Non-Qualifying Income |

Qualifying Income |

|---|---|---|---|

| Qualifying Activities from Non-FZ persons i.e. sales by QFZP to Non FZPs including Overseas Customers |

• Mainland Entity • Foreign Entity • Non FZP |

Income from activities that are ‘Not Qualifying Activities’ |

Income from ‘Qualifying Activities’ Subject to de minimis requirements |

| Not Excluded Activities from Other FZPs i.e. sale by QFZP to Other FZPs |

Other FZP’s in same Free Zone or Other Free Zones | Income from ‘Excluded Activities’ |

Income from ‘Non Excluded Activities’ Subject to de minimis requirements |